Filing a car insurance claim in India can feel confusing—especially during an accident or emergency. Most first-time car owners don’t know what to do first, whether FIR is needed, or how much will be deducted during the claim.

This complete guide explains the car insurance claim process in India with real examples, timelines, documents, IRDAI-based rules, pros & cons, and avoidable mistakes—so you never lose your claim.

Who Should Read This Guide

- First-time car owners

- Buyers planning insurance renewal

- Loan seekers with hypothecated cars

- Used car buyers dealing with RC + insurance transfer

- Anyone confused about cashless vs reimbursement claims

Main Keyword Used:

car insurance claim process India

Secondary Keywords Included:

- Car insurance claim processing fee in India

- How to claim insurance for car damage without FIR online

- Car insurance claim rules

- Car insurance claim process time

Why Claim Process Matters in India

In India, most people only look at premium price and ignore the claim experience, which matters the most.

Your loss settlement depends on:

- Policy type (zero-dep vs comprehensive)

- IDV (insured declared value)

- Deductibles

- Add-ons

- Claim history (affects NCB)

- RC & loan hypothecation status

A single mistake—like repairing without surveyor approval—can reject the claim completely.

Car Insurance Claim Process India

The car insurance claim process in India involves reporting the incident to the insurer within 24–48 hours, submitting documents, getting the surveyor inspection done, repairing at a cashless garage, and receiving approval. Claim time usually takes 3–7 working days, depending on damage and documents.

Types of Car Insurance Claims in India

1) Cashless Claim

- Repair at insurer-approved workshop

- Insurer pays directly to workshop

- You pay deductibles + non-covered items

2) Reimbursement Claim

- Repair anywhere

- You pay full bill first

- Insurer reimburses later after verification

Car Insurance Claim Processing Fee in India

Quick Answer

There is no processing fee for filing a car insurance claim in India.

However, you must pay:

- Compulsory deductible: ₹1,000 (cars <1500cc) / ₹2,000 (cars >1500cc)

- Voluntary deductible (if selected for lower premium)

- Depreciation (if not zero-dep)

- Consumable charges (oil, nuts, coolant)—unless add-on taken

As per IRDAI rules, insurers cannot charge claim filing fees.

Step-by-Step Car Insurance Claim Process in India

Follow this exact Indian-specific sequence:

Step 1: Inform the Insurer Immediately

- Call customer care or use app

- Report within 24–48 hours (mandatory for most insurers)

- Provide policy number, location, and damage details

Pro Tip: Take photos before moving the vehicle.

Step 2: Do NOT Repair Before Surveyor Approval

- Insurer assigns a surveyor

- Physical or digital inspection

- Repairing early may cause claim rejection

Step 3: File FIR Only If Required

When FIR is mandatory

- Major accident causing injury/death

- Theft of car

- Third-party property damage

- Hit-and-run cases

When FIR is NOT required

- Minor dents

- Scratches

- Windshield damage

- Single-party parking damage

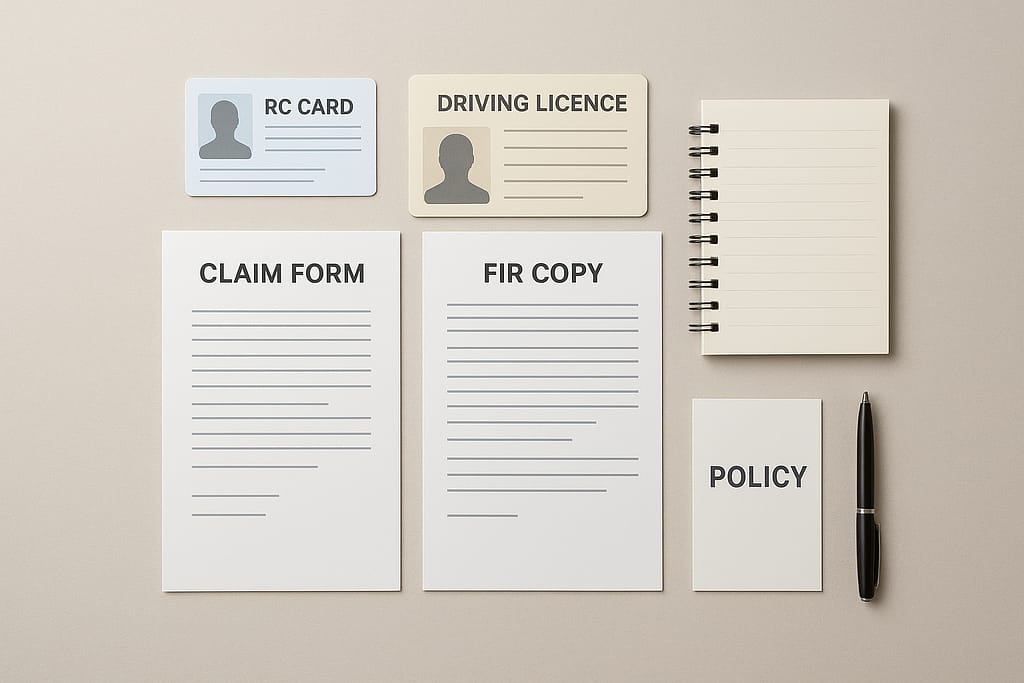

Step 4: Submit Required Documents

| Document Required | When Needed |

| RC | Always |

| Driving Licence | Always |

| Policy Copy | Always |

| FIR/Police Memo | Only if applicable |

| Claim Form | Online or offline |

| PAN + Aadhaar | High-value claims (as per KYC norms) |

| Bank details | Reimbursement cases |

Keep original bills for reimbursement claims.

Step 5: Get Repair & Final Settlement

For cashless claims:

- Insurer settles directly with workshop

- You pay deductible + non-covered items

For reimbursement:

- Submit final bills

- Settlement takes 5–14 working days

Car Insurance Claim Process Time in India

The average car insurance claim process time in India is 3–7 days for cashless repairs and 7–14 days for reimbursement claims, depending on damage severity, document submission, and surveyor approval. Theft claims may take 30–90 days as per police verification requirements.

How to Claim Insurance for Car Damage Without FIR Online

You can file a car damage claim without FIR for minor dents, scratches, self-damage, or windshield cracks by uploading photos, RC, DL, and policy details through the insurer’s app or website. FIR is needed only for third-party, theft, or injury cases.

What is Covered & Not Covered in a Car Claim

Covered

- Accidental damage

- Fire & natural disasters

- Theft (full IDV payout)

- Third-party liability

- Glass damage

Not Covered

- Drunk driving

- Expired policy

- Driver without valid DL

- Consequential damage (engine hydro-lock)

- Illegal accessories

Zero-Dep vs Normal Claim Example

Damage cost: ₹20,000 (front bumper, headlamp)

Depreciation on plastic: 50%

Without Zero-Dep

| Cost Component | Amount (₹) |

| Plastic parts (₹12,000 × 50%) | 6,000 |

| Compulsory deductible | 1,000 |

| Total you pay | 7,000 |

With Zero-Dep

| Cost Component | Amount (₹) |

| Depreciation | 0 |

| Deductible | 1,000 |

| Total you pay | 1,000 |

Zero-dep saves ₹6,000 in one claim.

Special Case: Total Loss & Theft Claims

Total Loss

- Repair cost >75% of IDV

- Insurer pays IDV amount

- RC cancellation required at RTO

Theft Claim

- FIR mandatory

- Final police untraceable report required

- Settlement may take 60–90 days

RC, Loan & Insurance Claim Rules

If car is on loan

- RC shows hypothecation

- Bank NOC needed for total loss

- Settlement goes to bank first

If RC transfer pending

- Claim may get delayed

- Inform insurer immediately

IRDAI rule: Policy must match correct owner details.

Sample EMI Table

Sometimes the owner pays repair cost using finance or credit.

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹50,000 | 14% APR | 12 months | ₹4,504/month |

Use loans only for unavoidable expenses.

Pros & Cons of Filing a Car Insurance Claim

| Pros | Cons |

| Saves major repair cost | NCB loss increases next premium |

| Cashless convenience | Deductibles still payable |

| Protects finances during emergencies | Frequent claims may cause loading |

Tips to Avoid Claim Rejection in India

- Never repair before survey

- Don’t drive drunk or without DL

- File claim within 48 hours

- Keep policy active—no grace period

- Install AIS-140 GPS for commercial vehicles

- Take photos & videos at the spot

Conclusion:

Filing a car insurance claim in India is easy when you follow the correct step-by-step process and avoid common mistakes. Always prioritise safety, report on time, and understand what is covered—so your claim is never rejected.

FAQs:

Q. What is the car insurance claim process in India?

A. You should report the incident to the insurer within 24–48 hours, submit required documents such as RC, driving licence, and claim form, and wait for a surveyor inspection. After approval, get the vehicle repaired at a cashless workshop or pay first for reimbursement. Claim approval usually takes 3–7 working days.

Q. How long does a car insurance claim take in India?

A.

Cashless claims: 3–7 working days

Reimbursement claims: 7–14 days

Theft claims: 30–90 days, depending on police investigation and verification

Q. Can I claim car insurance without an FIR?

A. Yes, an FIR is not required for minor accidents or windshield damage. An FIR is mandatory only for theft, third-party injury, hit-and-run cases, or major accidents.

Q. Is there a processing fee for car insurance claims in India?

A. No. As per regulations, insurers do not charge any claim processing fee. You only need to pay mandatory deductibles and non-covered expenses.

Q. How many times can I claim car insurance in a year?

A. There is no fixed limit on the number of claims. However, multiple claims will reduce your No Claim Bonus (NCB) and may increase your next year’s premium through loading.