Buying a car in India often starts with one big financial question:

Should you take a car loan or a personal loan to buy your car?

With rising interest rates, stricter loan eligibility, and higher on-road prices, choosing the right loan type can save you ₹50,000–₹2 lakh over the repayment period.

This complete guide explains the car loan vs personal loan India comparison with real EMI examples, bank rules, CIBIL impact, pros & cons, and when each option makes financial sense.

A car loan is better for most buyers because it offers lower interest rates, higher loan amounts, and longer tenure. A personal loan is useful only if you need quick funds, want to buy an old car (8–10 years), or avoid hypothecation. Car loans are cheaper but have more restrictions.

Car Loan vs Personal Loan – Key Differences

| Feature | Car Loan | Personal Loan |

| Interest rate | 8.7–11% | 10.5–18% |

| Security | Car hypothecated to bank | Unsecured |

| Loan-to-value | Up to 90–100% of on-road price | Depends on income & CIBIL |

| Tenure | 1–7 years | 1–5 years |

| Processing time | 1–3 days | Same day–3 days |

| Used car eligibility | Only up to 5–7 year old | Any age vehicle |

| Ownership | Bank lien until closure | Full ownership from day one |

What Is a Car Loan?

A car loan is a secured loan where the bank finances the vehicle and keeps it hypothecated until you repay the full EMI.

Features:

- Lower interest rates

- EMI based on car value

- RC will show hypothecation

- NOC required to remove after closing loan

Best for:

- New cars

- Used cars up to 5–7 years (bank dependent)

What Is a Personal Loan for Car Purchase?

A personal loan is an unsecured loan where the bank gives money without using the car as security.

Features:

- Higher interest rate

- No hypothecation in RC

- Full ownership remains with buyer

- Faster approval

Best for:

- Buying an old car (8–10+ years)

- Buying from individual sellers

- People who cannot get car loan approval

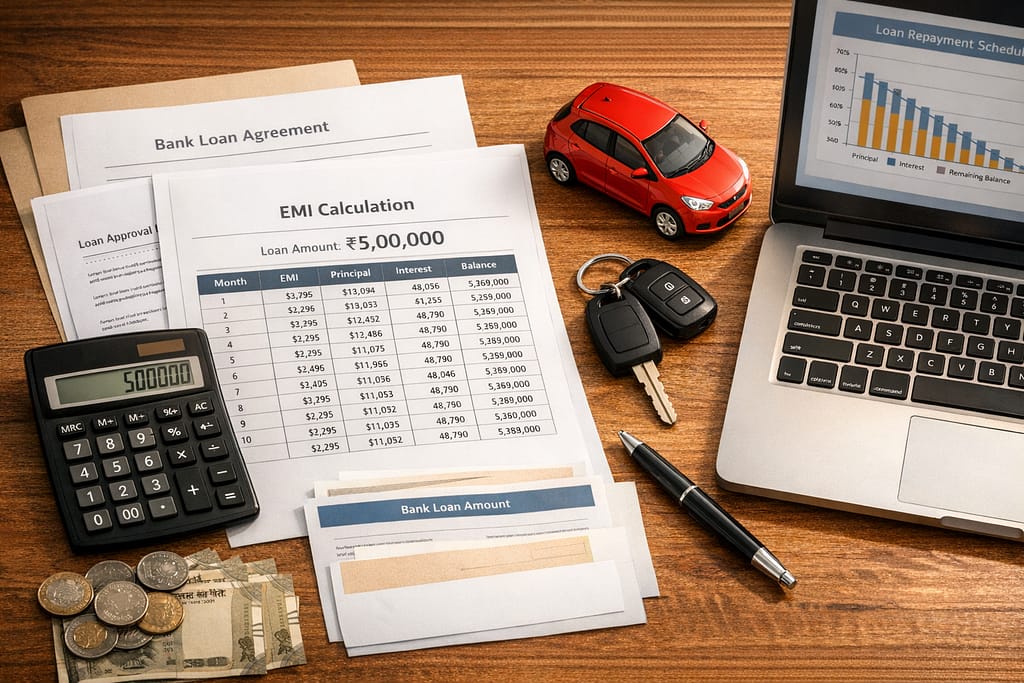

Real EMI Example: Car Loan vs Personal Loan for Same Car

Scenario:

Buying a car worth ₹6 lakh on-road.

Loan Terms Comparison

| Loan Type | Loan Amount | Interest Rate | Tenure | Monthly EMI |

| Car Loan | ₹5,00,000 | 9% | 5 years | ₹10,377 |

| Personal Loan | ₹5,00,000 | 13.5% | 5 years | ₹11,590 |

Cost Difference:

- Extra EMI = ₹1,213/month

- Extra cost over 5 years = ₹72,780

Car loan is clearly cheaper—if eligible.

Loan Eligibility: What Banks Check in India

For Car Loans (SBI, HDFC, ICICI, Axis)

- CIBIL score 700+

- Minimum income: ₹20,000–₹30,000/month

- Age of car (if used): usually <7 years

- Stable employment records

- Down payment required: 10–25%

For Personal Loans

- CIBIL score 750+ preferred

- Minimum income: ₹25,000–₹40,000/month

- Higher documentation strictness

- Shorter tenure limits

Practical Tip:

Improve CIBIL before applying — even a 30–50 point increase can reduce rates.

When Car Loan Is Better

Choose car loan if:

- You’re buying a brand-new car

- Want lower EMI

- Need longer tenure (up to 7 years)

- Have CIBIL ≥ 700

- Want up to 90–100% funding

- Planning to keep car for several years

Ideal for:

- First-time car buyers

- Family buyers

- Salaried employees with stable income

When Personal Loan Is Better

Choose personal loan if:

- Buying a very old used car (8–12 years)

- Buying from individual seller without invoice

- Already have existing car loan

- You don’t want hypothecation on RC

- Need quick funds with no car valuation process

Useful for:

- Students buying budget used cars

- People upgrading with cash discounts

- Buying out-of-state used cars

Car Loan vs Personal Loan Interest Rates in India

Car Loan Rates (Approx)

| Bank | Interest Rate | Processing Fee |

| SBI | 8.75–9.25% | ₹2,000–₹5,000 |

| HDFC Bank | 9–10.5% | Up to 1% |

| ICICI Bank | 9–11% | Up to 1% |

| Axis Bank | 9–10.75% | ₹3,500 onwards |

Personal Loan Rates (Approx)

| Bank | Interest Rate | Processing Fee | Min Salary Required |

| HDFC Bank | 10.5–18% | Up to 2% | ₹25,000/month |

| ICICI Bank | 11–17.5% | Up to 2% | ₹25,000/month |

| SBI | 11–15% | Up to 1.5% | ₹20,000/month |

| Axis Bank | 10.99–18% | Up to 2% | ₹20,000–₹25,000/month |

Rates vary by CIBIL, employer category, city, and income proof.

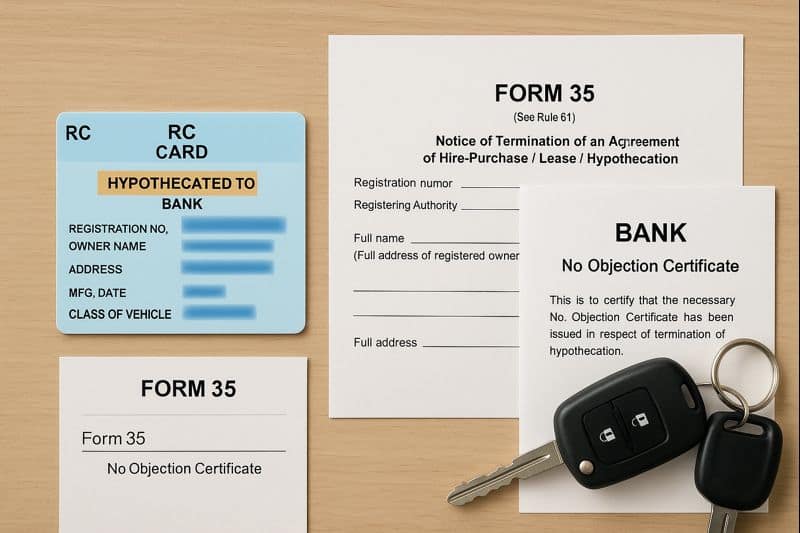

Hypothecation: What Most First-Time Buyers Miss

With a car loan, your RC will show:

Hypothecated to: <Bank Name>

Meaning:

- You cannot sell the car without bank clearance

- NOC + Form 35 needed after loan closure

- Delay can cause insurance & RTO issues

With Personal Loan:

- No hypothecation

- Sell car anytime

But you pay more interest for that freedom.

Total Ownership Cost Impact

Car loans:

- Lower interest = lower overall cost

- But higher insurance (OD + IDV)

- Must take comprehensive cover first year

Personal loans:

- Higher interest = higher overall cost

- But flexible insurance choice

Pros & Cons Summary

Car Loan – Pros

- Low interest rates

- Higher loan amount

- Longer tenure

- Suitable for new cars

Car Loan – Cons

- Hypothecation restrictions

- Down payment required

- Documentation inspection

Personal Loan – Pros

- No hypothecation

- Quick processing

- Can buy any car

Personal Loan – Cons

- High interest rates

- Shorter tenure

- Smaller loan amount

Tips Before Choosing Your Loan

- Maintain CIBIL above 750

- Keep EMI below 25% of monthly income

- Compare processing fees, not only interest rate

- Avoid 0 down payment car loans—higher interest

- Choose shorter tenure to reduce total interest

- Check foreclosure charges for both loan types

Conclusion:

Choose a car loan if:

- You’re buying a new or recent used car

- Want lower EMI and total interest

- Have good CIBIL and steady income

Choose a personal loan if:

- Buying an old used car

- Need funds urgently

- Don’t want hypothecation

FAQs

Q. Car loan vs personal loan in India which is better?

A. A car loan is better for most buyers because it offers lower interest rates and a longer repayment tenure. A personal loan is suitable only if you are buying a very old used car or want to avoid hypothecation on the vehicle.

Q. Can I buy a second-hand car with a car loan?

A. Yes, you can, but only if the car is generally within 5–7 years of age, depending on the bank’s policy. Older cars usually require a personal loan or a cash purchase.

Q. What is a car loan vs personal loan calculator in India?

A. It is a comparison tool that calculates EMI, total interest, and overall repayment cost for both car loans and personal loans based on the loan amount, interest rate, and tenure, helping you choose the cheaper option.

Q. Is personal loan interest higher in India?

A. Yes. Personal loans are unsecured and usually have interest rates between 10.5%–18%, while car loans are secured and typically range from 8.7%–11%.

Q. Can I sell my car if it has an active car loan?

A. No, not directly. You must first close the loan, obtain a No Objection Certificate (NOC) from the bank, and remove the hypothecation from the RC before transferring ownership.