If you are buying or renewing car insurance in India—especially as a first-time car owner or loan borrower—you will often hear the term IDV. Many people ignore it, but IDV directly affects your premium, claim amount, and total ownership cost.

This guide explains what is IDV in car insurance India in the simplest way, with examples, formulas, and real Indian scenarios.

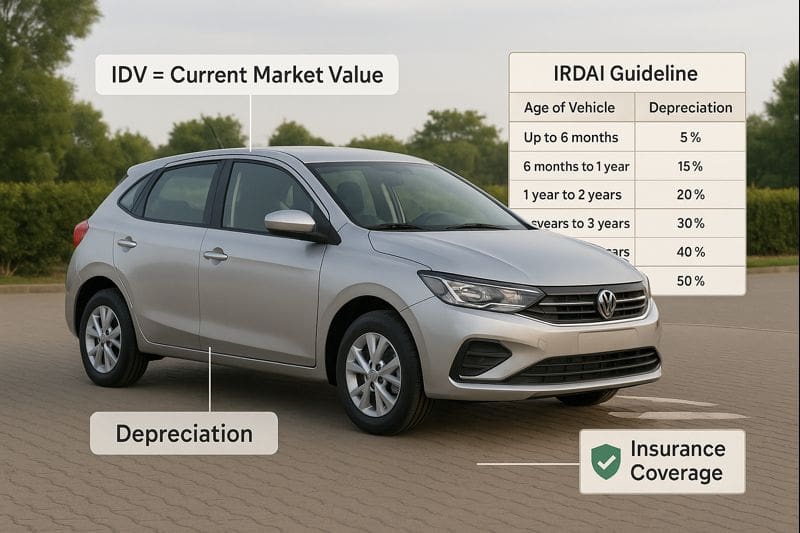

What Is IDV in Car Insurance?

IDV (Insured Declared Value) is the current market value of your car used by the insurer to calculate your premium and the maximum claim amount in case of total loss or theft. Higher IDV means higher coverage and a slightly higher premium.

Why IDV Matters for Indian Car Owners

IDV is important because it influences:

- Your insurance premium

- Your claim payout in theft/total damage

- Loan protection in case of an accident

- Your car’s resale and ownership planning

Many buyers choose a lower premium without realizing they are reducing their compensation during claims.

Basic IDV Formula as per IRDAI

IDV = Manufacturer’s listed price – Depreciation (%) + Cost of accessories (if not in standard price)

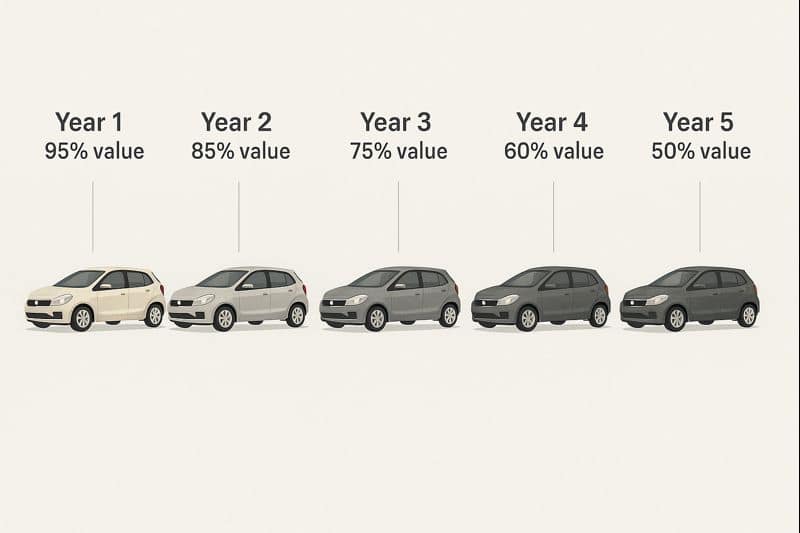

Standard Depreciation for IDV (IRDAI Guidelines)

| Vehicle Age | Depreciation % | Approx IDV Value |

| 0–6 months | 5% | 95% of price |

| 6–12 months | 15% | 85% of price |

| 1–2 years | 20% | 80% of price |

| 2–3 years | 30% | 70% of price |

| 3–4 years | 40% | 60% of price |

| 4–5 years | 50% | 50% of price |

After 5 years, IDV is decided mutually between insurer and owner based on the IDV calculator, inspection, and car condition.

Real Indian Example: IDV Calculation

Car Details

- Model: Maruti Swift VXI

- Ex-showroom price: ₹7,00,000

- Age: 2 years

Step-by-step calculation

- Depreciation = 30%

- Depreciated value = 7,00,000 – (30%)

= 7,00,000 – 2,10,000

= ₹4,90,000 - No extra accessories added

Final IDV = ₹4,90,000

Is IDV Value Important in Car Insurance?

Yes. IDV is important because it decides the maximum amount you receive if your car is stolen or damaged beyond repair. Choosing a very low IDV just to reduce premium can lead to huge financial loss during claims.

IDV and Car Loans: What Most People Don’t Know

If your car is financed through a bank like HDFC Bank, SBI, ICICI, Axis, or NBFCs such as Bajaj Finance, IDV impacts:

- Loan hypothecation coverage

- Risk for lender in total loss

- Your out-of-pocket cost if claim < outstanding loan

Example:

If your outstanding car loan is ₹4 lakh, but your IDV is only ₹3 lakh, and the car is stolen:

➡ You will still need to pay ₹1 lakh to the bank.

Why Insurers Reduce IDV Every Year

Because your car naturally depreciates due to:

- Wear and tear

- Age and usage

- Model discontinuation

- Market resale value

This is not negotiable, but insurers allow small variations (usually ±10%).

Common Mistake: Choosing the Lowest IDV to Save Premium

Short-term benefit

- Premium reduces by 5–12%

Long-term risk

- Claim payout reduces significantly

- Financial loss in theft

- Loan liability remains

Always balance premium vs. protection—not the cheapest quote.

When Should You Choose Higher or Lower IDV?

Choose Higher IDV if:

- Car is new (0–3 years)

- You park outside

- High-risk cities (Delhi NCR, Mumbai, Bengaluru)

- Running an active car loan

- Planning to sell within 1 year

Choose Lower IDV if:

- Car is 8–10 years old

- You want lower premium

- Car has low resale value

Warning: Don’t reduce IDV below reasonable range. Always match IRDAI table.

What Is IDV Calculator?

An IDV calculator is an online tool used by insurers to estimate your car’s current value based on model, age, location, and depreciation, helping you choose the right coverage while renewing car insurance in India.

Factors That Affect IDV in India

Vehicle-related

- Age and manufacturing year

- Ex-showroom price

- Variant and fuel type

- Accessories value

Market-related

- Resale demand

- City of registration (RTO code)

- Model discontinuation (e.g., Ford cars)

Policy-related

- Type (Comprehensive vs. Third-party)

- Add-ons (Zero Depreciation, RTI)

Third-party insurance does not use IDV because it covers only legal liability.

IDV and Add-ons: What You Should Know

Zero Depreciation Cover

- Ideal for cars under 5 years

- Claim amount ignores depreciation

- But payout cannot exceed IDV

Return to Invoice (RTI)

- Restores full invoice value

- Useful in new cars (<3 years)

- Covers:

- ex-showroom price

- road tax

- registration charges

RTI is extremely helpful when financing with low down payment EMI.

Ownership Cost Impact Example

| Year | Insurance Premium | Selected IDV | Total Ownership Cost Impact |

| Year 1 | ₹22,000 | ₹7,00,000 | Higher safety for new car |

| Year 2 | ₹18,000 | ₹4,90,000 | Standard depreciation |

| Year 3 | ₹15,500 | ₹4,20,000 | Lower resale, moderate risk |

Loan Scenario: EMI + IDV Impact

Assume you purchased a ₹6 lakh Swift on loan.

Loan Terms

- Interest rate: 9%

- Tenure: 5 years

- Down payment: ₹1 lakh

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹5,00,000 | 9% | 5 years | ₹10,377 approx |

Risk Case

If the car is stolen in year 2:

- Outstanding loan: ₹4,10,000

- Selected IDV: ₹3,40,000

➡ You pay ₹70,000 from your pocket.

Choosing a realistic IDV protects your finances during a crisis.

Pros & Cons of Higher IDV

Advantages

- Higher claim settlement

- Better financial security

- Useful during active loan

- Supports resale negotiations

Disadvantages

- Slightly higher premium

- Not necessary for very old cars

Tips to Select the Right IDV in India

- Don’t reduce IDV below IRDAI guidelines

- Compare quotes from at least 3 insurers

- Avoid unrealistically high IDV—claim may get rejected

- Use zero dep for cars <5 years

- Use RTI for new financed cars (<3 years)

- Recalculate IDV after adding accessories

- Keep RC and invoice ready during claims

Conclusion:

IDV is not just a number—it protects your financial safety, especially if you are a first-time buyer, EMI payer, or living in a high-risk city. Always select a balanced IDV, not the cheapest premium.

Before renewing your policy:

- Check your car’s age and depreciation

- Use an IDV calculator

- Compare at least 2–3 insurer quotes

- Prefer zero dep and RTI for newer cars

FAQs

Q. What is IDV in car insurance in India?

A. IDV (Insured Declared Value) is the current market value of your car and the maximum amount the insurer will pay in case of total loss or theft. It also directly affects your comprehensive car insurance premium.

Q. Does third-party car insurance need IDV?

A. No. Third-party insurance does not require IDV because it only covers legal liabilities toward a third party and does not cover damage to your own vehicle.

Q. Can I increase my IDV while renewing car insurance?

A. Yes. You can request a higher IDV within the acceptable range (usually ±10%). The insurer may require a vehicle inspection before approving the change.

Q. What is the difference between IDV and Zero Depreciation?

A. IDV represents your car’s market value. Zero Depreciation is an add-on cover that removes depreciation on parts during claims, but the total claim payout cannot exceed the IDV.

Q. What is an IDV calculator in car insurance?

A. An IDV calculator is an online tool that estimates your car’s value based on factors like model, age, and depreciation, helping you choose the right insurance coverage.