Buying a car in India is no longer just an emotional decision. With rising EMIs, insurance premiums, and strict RC and resale rules, you must compare the total ownership cost before deciding between a new car and a used car.

This detailed guide breaks down the new vs used car cost India with real calculations, EMI tables, maintenance comparison, and practical advice for first-time buyers and loan seekers.

A new car offers lower maintenance, full warranty, better loan interest rates, and higher reliability but costs more upfront. A used car is cheaper to buy and has lower EMI but may require higher repairs, limited warranty, and faster depreciation. Choose based on your running, budget, and loan eligibility.

Why This Decision Matters in India (2025 Context)

You must consider:

- Higher on-road cost due to insurance, GST, registration

- Increased interest rates on car loans

- Stricter RTO fitness & RC transfer rules

- Depreciation hitting resale value quickly

- Used car prices rising due to demand from Tier-2 & Tier-3 cities

This is not about “new vs used emotionally”,

but “which option saves more money over 5–8 years?”

New vs Used Car – Key Cost Difference (Quick Comparison)

| Factor | New Car | Used Car |

| On-road price | Highest | 30–45% cheaper |

| Loan interest rate | 8.7–10% | 11–15% |

| Insurance | Comprehensive + higher IDV | Lower IDV, cheaper premium |

| Maintenance | Very low for 3–5 years | Higher after purchase |

| RC transfer | Not needed | Mandatory + fee |

| Warranty | Full manufacturer warranty | Limited or none |

| Resale value | Higher at 5 years | Lower depending on age |

How Much Does a New Car Depreciate in India?

Standard depreciation (real-world):

| Age | Depreciation % | Value Left |

| 1 year | 15% | 85% |

| 3 years | 35% | 65% |

| 5 years | 50% | 50% |

| 8+ years | 65–70% | 30–35% |

Meaning:

A ₹10 lakh car becomes ₹6.5 lakh in 3–4 years.

That’s why the used car market is attractive—someone else absorbs the biggest loss.

Real EMI Example: New vs Used Car Loan

Scenario:

You are buying a Maruti Swift VXI.

Prices:

- New car on-road: ₹8,00,000

- 3-year-old used car: ₹5,20,000

Loan Terms:

- Down payment: ₹1,00,000

- New car loan interest: 9%

- Used car loan interest: 13%

- Tenure: 5 years

| Variant | Loan Amount | Interest Rate | Tenure | Monthly EMI |

| New Car | ₹7,00,000 | 9% | 5 years | ₹14,565 |

| Used Car | ₹4,20,000 | 13% | 5 years | ₹9,557 |

EMI Difference:

➡ ₹5,008/month cheaper for used car

➡ Savings over 5 years = ₹3,00,480

But EMI is not the only cost to consider.

Ownership Cost Comparison (5-Year Real Example)

Car Type: Compact hatchback (e.g., Swift, i20)

| Expense Type | New Car (₹) | Used Car (₹) |

| On-road cost | 8,00,000 | 5,20,000 |

| EMI impact (5 years) | 8,73,900 (total paid) | 5,73,420 (total paid) |

| Insurance (5 years) | 75,000 | 45,000 |

| Maintenance (5 years) | 35,000 | 95,000 |

| Depreciation loss | 3,60,000 | 1,20,000 |

| RC transfer | — | 3,500–8,000 |

| Total 5-year ownership cost | 13,43,900 | 9,36,420 |

Result:

Used car saves ₹4–4.5 lakh over 5 years

But only if you buy a clean, non-accidental, 1–5-year-old car.

Insurance & IDV Differences

New Car:

- High IDV

- Higher premium (own damage + zero-dep)

- Must take comprehensive for at least year 1

Used Car:

- Lower premium

- IDV decided based on age & inspection

- Zero-dep optional only up to 5 years

Annual premium difference:

₹3,000–₹10,000 depending on segment.

Maintenance & Repair Comparison

New Car (first 3 years):

- Mostly free/low-cost services

- Minimal part failures

- Warranty covers repairs

Used Car:

| Component | Possible Cost (₹) |

| Clutch overhaul | 8,000–18,000 |

| Suspension work | 12,000–25,000 |

| Tyres replacement | 14,000–32,000 |

| Battery | 4,500–7,000 |

| Brake overhaul | 5,000–12,000 |

Buying from random sellers increases hidden repair risk.

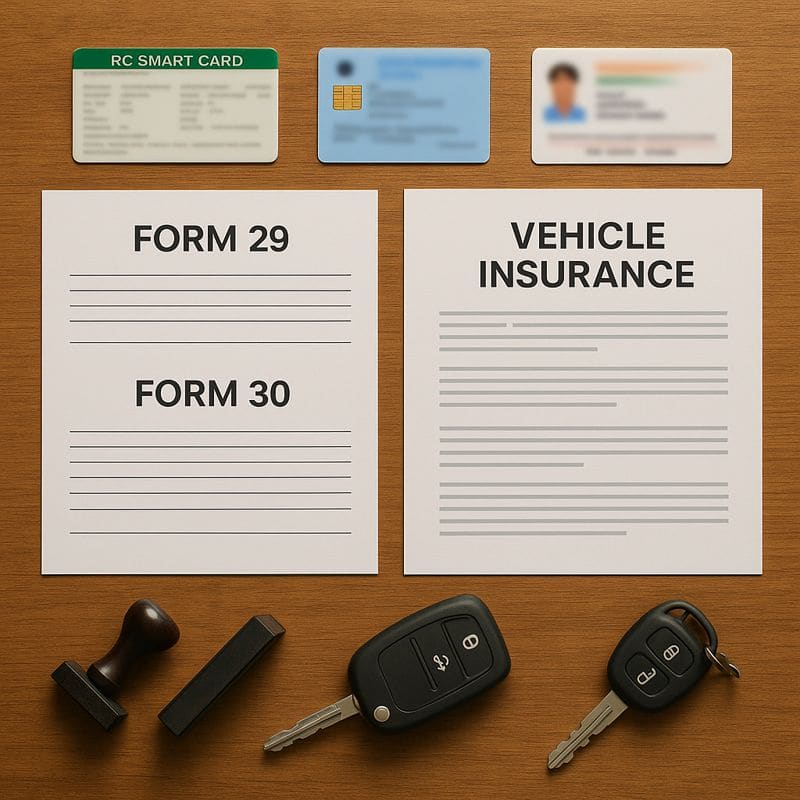

RC Transfer, RTO & Legal Costs

For used cars:

- Form 29 & 30 submission

- Hypothecation removal (if previous loan)

- Road tax not refundable across states

- NOC required for interstate transfer

- RTO fee: ₹350–₹1,000

- Agent charges: ₹1,500–₹4,000 (optional)

RC transfer delay risks:

- Challan liability

- Accident legal issues

- Insurance claim rejection

When Should You Buy a New Car in India?

Choose a new car if:

- You plan to keep it 8–10 years

- You need high reliability

- You drive daily long distances

- You want the latest safety features

- You can pay 20–30% down payment

- Your CIBIL score > 750 (lower interest rate)

Also ideal for:

- First-time owners

- Families with children

- Frequent highway travel

When Is a Used Car Better Financially?

Choose a used car if:

- Your budget is limited

- You want lower EMI

- Annual driving < 10,000 km

- You plan to upgrade in 3–4 years

- You find a non-accidental, low-running car

- Prefer value over latest features

Used car is smarter for:

- Students

- New job joiners

- City-only driving

- Second family car

How Much Old Car Should You Buy in India?

Best age range:

1–5 years old

Why?

- Depreciation already absorbed

- Still under warranty (sometimes extended)

- Parts in good condition

- RC validity remains high

Avoid:

Cars older than 8–10 years

Especially diesel in Delhi-NCR (10-year ban)

Step-by-Step Checklist Before Buying a Used Car

Verify documents

- RC details & chassis match

- Insurance status (OD + TP)

- Service history

- NOC (if inter-state)

- Hypothecation removal (Form 35)

Physical inspection

- Engine noise & smoke

- Panel gaps & repaint marks

- Tyre & suspension condition

Diagnostic scan (preferred)

- ABS/airbag error

- ECU tampering

- Odometer fraud (common)

Test drive

- Cold start behaviour

- Gear vibration

- Steering & braking

Buying from certified dealers reduces risk but costs more.

Pros & Cons Summary

New Car – Pros

- Full warranty

- Latest safety & tech

- Lower maintenance

- Better financing options

New Car – Cons

- Fast depreciation

- Higher EMI & insurance cost

Used Car – Pros

- Lower buying & EMI cost

- Slow depreciation

- More value for money

Used Car – Cons

- Higher repair risk

- Limited warranty

- Higher loan interest

Conclusion:

If you want peace of mind, long-term ownership, and lower maintenance, a new car is the better choice.

If your goal is lower EMI, lower upfront cost, and smart financial value, a 1–5-year-old used car can save ₹3–5 lakh over 5 years.

FAQs

Q. Should I buy a new or used car in India?

A. Buy a new car if you want better reliability, long-term ownership, and lower maintenance concerns. Buy a used car if you want a lower EMI and budget-friendly ownership, provided the vehicle is properly verified and in good condition.

Q. When is the right time to buy a car financially in India?

A. You should consider buying a car when you can make a 20–30% down payment, have a CIBIL score above 750, and ensure that the EMI does not exceed 20–25% of your monthly income, as recommended by most banks.

Q. Which car is best to buy second-hand in India?

A. Reliable second-hand options usually include models from Toyota, Honda, Maruti, and Hyundai, as they offer low maintenance costs, easy spare parts availability, and strong resale value.

Q. How old a used car should I buy in India?

A. Ideally, you should buy a car that is 1–5 years old. Avoid vehicles older than 8–10 years, especially diesel cars in NCR, due to RTO restrictions.

Q. Is used car loan interest higher in India?

A. Yes. Used car loan interest rates typically range from 11–15%, while new car loan rates are lower at around 8.7–10%, depending on the bank, CIBIL score, and income profile.