The Tata Nexon is one of India’s most popular compact SUVs, but choosing the right EMI and down payment is just as important as selecting the variant.

This complete Tata Nexon EMI calculator guide explains EMI formulas, real examples, down payment options, zero down payment scenarios, and 2025 loan rates in simple Indian English.

Whether you’re a first-time buyer or planning an upgrade, this article helps you calculate EMI confidently—without confusion.

Why EMI Calculation Matters Before Buying Nexon

Car buyers often focus only on on-road price, but your actual monthly cost depends on:

- Loan interest rate

- Down payment amount

- Tenure (years)

- Processing fees

- Insurance & RC charges

Even a 1% interest change can impact EMI and total payable by ₹20,000–₹40,000 over the loan period.

This guide simplifies EMI with real Indian numbers, RBI-based facts, and practical finance tips.

Tata Nexon 2025 On-Road Price

Prices vary by state, RTO, insurance, and location.

| Variant | On-Road Price Range (Approx) |

| Nexon Smart (Petrol) | ₹9.2 – ₹9.8 lakh |

| Nexon Pure | ₹10.3 – ₹11.2 lakh |

| Nexon Creative+ | ₹12.1 – ₹13.3 lakh |

| Nexon Fearless+ S | ₹14.8 – ₹15.9 lakh |

| Nexon Diesel Variants | ₹11.5 – ₹15.8 lakh |

Includes RTO, insurance, Fastag, handling; may vary by city.

What Is EMI?

EMI (Equated Monthly Instalment) is the fixed amount you pay every month to repay your car loan, which includes:

- Principal amount

- Interest

EMI Formula

EMI = P × R × (1+R)^N ÷ (1+R)^N – 1

Where:

- P = Loan amount

- R = Monthly interest rate (annual rate/12/100)

- N = Tenure in months

Don’t worry—we’ll calculate it for you with real Nexon examples.

Tata Nexon EMI Calculator

Case 1: ₹10 Lakh Loan at 9% for 5 Years

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹10,00,000 | 9% | 60 months | ₹20,729 approx |

Total Interest: ~₹2,43,700

Total Payable: ~₹12,43,700

Case 2: ₹10 Lakh Loan at 10.5% for 5 Years

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹10,00,000 | 10.5% | 60 months | ₹21,566 approx |

Extra Interest Paid vs 9%: ~₹50,000+

Case 3: ₹10 Lakh Loan at 9% for 7 Years

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹10,00,000 | 9% | 84 months | ₹16,084 approx |

Lower EMI but total interest crosses ₹3.5 lakh.

Tata Nexon EMI Down Payment Options

Most banks finance 80–90% of on-road price.

Recommended Down Payment

| On-Road Price | Minimum DP Required (10–15%) | Suggested DP (20–25%) |

| ₹10 lakh | ₹1–1.5 lakh | ₹2–2.5 lakh |

| ₹12 lakh | ₹1.2–1.8 lakh | ₹2.4–3 lakh |

A higher DP reduces EMI and interest significantly.

Tata Nexon Zero Down Payment EMI Calculator

Zero DP is not offered directly by banks.

It is possible only when:

- NBFC funds 100% on-road + accessories

- Co-applicant with strong CIBIL

- Salary account customer with pre-approved offer

Zero Down Payment Reality Check

| Loan Amount | Rate | Tenure | EMI |

| ₹12,00,000 | 11% | 60 months | ₹26,082 approx |

Risks:

- Higher interest

- Higher insurance + hypothecation cost

- Strict eligibility

How to Calculate EMI for Tata Nexon (Step-by-Step Guide)

Step 1: Find your on-road price

Check:

- Ex-showroom

- RTO tax

- Insurance

- Fastag

- Handling

Step 2: Decide down payment

Higher DP = lower EMI.

Step 3: Choose tenure

- 3 years → high EMI, lowest interest

- 5 years → balanced

- 7 years → low EMI, highest interest

Step 4: Check interest rate

Depends on:

- CIBIL score

- Income

- Bank vs NBFC

- New vs used Nexon

Step 5: Use EMI formula or calculator

Loan Eligibility for Tata Nexon

Minimum Requirements

- Age: 21–65 years

- CIBIL score: 700+ preferred

- Salary:

- Metro: ₹22,000+

- Non-metro: ₹18,000+

Self-Employed

- ITR (2 years)

- GST registration

- Current account statements (12 months)

Factors Affecting EMI approval

- Down payment

- Existing EMIs (DTI < 40%)

- Job stability (1 year minimum)

- Banking history

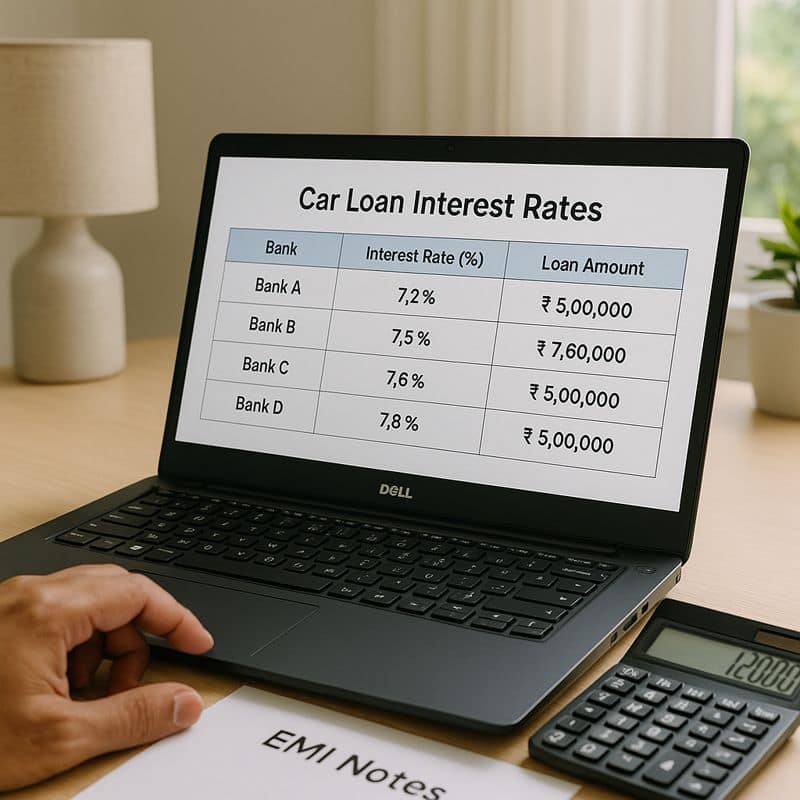

Bank-wise Car Loan Comparison for Nexon

| Bank | Interest Rate | Processing Fee | Min Salary |

| SBI | 8.7–9.2% | ₹2,000–₹5,000 | ₹15,000 |

| HDFC Bank | 8.9–10.5% | Up to 1% | ₹20,000 |

| ICICI Bank | 9–10.75% | ₹3,500+ | ₹20,000 |

| Axis Bank | 9.1–10.4% | ₹3,500–₹6,000 | ₹18,000 |

| Tata Capital (NBFC) | 10.5–14% | 1–2% | Flexible |

Rates depend on CIBIL and city.

Ownership Cost Beyond EMI

| Year | Service Cost | Insurance | Maintenance | Total |

| 1 | ₹5,000 | ₹32,000 | ₹3,500 | ₹40,500 |

| 2 | ₹7,500 | ₹28,000 | ₹4,000 | ₹39,500 |

| 3 | ₹10,000 | ₹26,000 | ₹6,000 | ₹42,000 |

| 4 | ₹11,500 | ₹24,000 | ₹7,000 | ₹42,500 |

| 5 | ₹13,000 | ₹22,000 | ₹8,000 | ₹43,000 |

IRDAI note: IDV decreases each year—review coverage to avoid underinsurance.

Pros & Cons of Financing a Nexon

Pros

- Easy monthly budgeting

- Builds credit score

- Access to higher variant without full cash

Cons

- Interest increases total cost

- Zero DP loans are expensive

- Long tenure reduces resale benefit

Tips to Reduce Tata Nexon EMI

- Maintain CIBIL 750+

- Make at least 20–25% down payment

- Choose shorter tenure

- Compare 3 banks + 1 NBFC

- Avoid taking loan in December price hikes

- Use pre-approved salary account offers

- Make part-prepayment when possible

Conclusion:

Calculating EMI correctly helps you avoid future financial stress. Always compare rates, increase down payment, and keep EMI under 25% of your monthly salary.

FAQ:

Q. What is the EMI for Tata Nexon on a ₹10 lakh loan?

A. For a ₹10 lakh loan over 5 years:

At 9% interest, the EMI is approximately ₹20,729 per month.

At 10.5% interest, the EMI increases to around ₹21,566 per month.

The final EMI depends on factors such as down payment amount, interest rate, and loan tenure.

Q. What is the minimum down payment for Tata Nexon?

A. Most banks require a minimum down payment of 10–15% of the car’s on-road price. However, making a 20–25% down payment is recommended to reduce your monthly EMI and overall interest cost.

Q. Can I get Tata Nexon on zero down payment?

A. A zero down payment option is possible only through select NBFCs for applicants with a strong credit profile, usually at a higher interest rate. Public sector banks generally do not offer zero down payment car loans.

Q. How can I calculate Tata Nexon EMI easily?

A. You can calculate Tata Nexon EMI using an online EMI calculator or the standard EMI formula by entering the loan amount, interest rate, and loan tenure. Sample EMI figures for a ₹10 lakh loan are provided above for reference.