Many first-time car buyers in India don’t have a credit history, while others worry due to past defaults.

So the big question is—can you get a car loan without CIBIL in India?

This complete car loan without CIBIL India guide explains real approval possibilities, interest rates, EMI examples, eligibility rules, documents, and safe options based on 2025 lending trends.

What Happens If You Have No CIBIL Score?

Not having a CIBIL score does not automatically mean loan rejection.

Banks follow RBI guidelines and can evaluate first-time borrowers using alternative credit checks.

However, lenders treat no credit history and CIBIL defaulters differently:

- No CIBIL / New-to-credit: Higher chances with documents

- Low CIBIL (550–650): Limited approval with higher rate

- CIBIL defaulters: Very rare approval, mostly via NBFCs or secured loans

This article shows legit options—no fake shortcuts or risky schemes.

Can You Get a Car Loan Without CIBIL in India?

Yes, you can get a car loan without CIBIL in India, but mostly through NBFCs, higher down payment, strong income proof, or a co-applicant with good credit.

Banks rarely approve such cases unless income and banking history are very strong.

Difference Between No CIBIL vs Bad CIBIL

| Profile Type | Meaning | Approval Chances |

| No CIBIL / New-to-credit | No past loans or credit cards | Medium |

| Low CIBIL (550–650) | Delays or irregular repayment | Low |

| Defaulter / Written-off | Unpaid loan or settlement | Very Low |

Past defaults stay in CIBIL for 7 years.

Best Options for Car Loan Without CIBIL (2025)

1. Apply Through NBFCs

Suitable for:

- First-time borrowers

- Self-employed

- Limited documents

Popular NBFCs:

- Tata Capital

- Shriram Finance

- Mahindra Finance

- Cholamandalam Finance

2. Add a Co-Applicant

Benefits:

- Higher approval chance

- Lower interest rate

Acceptable co-applicants:

- Parents

- Spouse

- Sibling

3. Increase Down Payment

Safe range:

- 30–40% for no CIBIL

- Lower risk = better approval

4. Provide Strong Financial Proof

Accepted instead of CIBIL:

- Salary slips (3–6 months)

- Bank statements (6–12 months)

- Form 16

- ITR for self-employed

5. Consider Secured Options

- Loan against Fixed Deposit

- Loan against gold

- FD-backed car loan

Avoid

- Middlemen offering “no CIBIL loan”

- Cash down payment without proof

- Fake CIBIL repair services

Car Loan Interest Rates Without CIBIL

| Lender Type | Interest Rate Range | Notes |

| Public Banks (rare approval) | 9% – 10.5% | Only with strong profile |

| Private Banks | 10% – 13% | Needs co-applicant |

| NBFCs | 12% – 18% | Flexible documentation |

| Used Car NBFC loan | 14% – 22% | Higher risk pricing |

Rates vary by city, income, employment, and vehicle type.

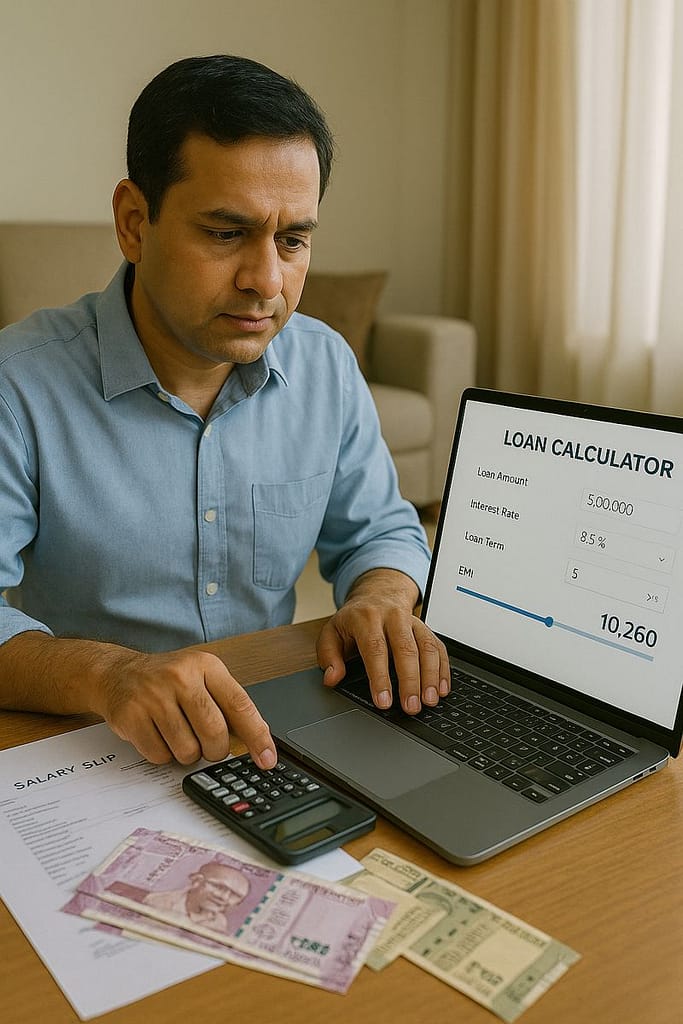

Car Loan EMI Calculator Example

EMI for ₹6 Lakh at 9% for 5 Years

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹6,00,000 | 9% | 60 months | ₹12,437 approx |

EMI for ₹6 Lakh at 14% for 5 Years (No CIBIL / NBFC)

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹6,00,000 | 14% | 60 months | ₹13,947 approx |

EMI for ₹6 Lakh at 14% for 7 Years (Long Tenure)

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹6,00,000 | 14% | 84 months | ₹11,295 approx |

Total Interest Comparison

| Scenario | Total Interest Paid |

| 9% for 5 years | ~₹1.46 lakh |

| 14% for 5 years | ~₹2.37 lakh |

| 14% for 7 years | ~₹3.52 lakh |

No-CIBIL loans may cost ₹90,000–₹2 lakh more.

Eligibility Rules for Car Loan Without CIBIL

Minimum Requirements

- Age: 21–60 years

- Stable job: 6–12 months minimum

- Monthly salary:

- Metro: ₹20,000+

- Non-metro: ₹15,000+

Self-Employed

- ITR for 2 years

- Business proof

- GST registration

Key Approval Factors

- Bank balance consistency

- No cheque bounce history

- Low DTI (Debt-to-income ratio < 40%)

Documents Required

Salaried

- Aadhaar + PAN

- Salary slips (3 months)

- Bank statements (6 months)

- Address proof

Self-Employed

- ITR of 2 years

- GST certificate

- Business registration

- Current account statement (12 months)

If Co-Applicant Added

- Same KYC + income documents

Used Car Loan for CIBIL Defaulters

Used cars have:

- Higher interest rate

- Lower LTV (loan-to-value 50–70%)

- More documentation checks

Most approvals happen through NBFCs, not banks.

Used Car Loan Example

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹4,00,000 | 18% | 48 months | ₹12,563 approx |

Always check RC transfer, IDV value, and insurance before signing.

Ownership Cost Beyond EMI

| Year | Service Cost | Insurance | Maintenance | Total |

| 1 | ₹4,000 | ₹22,000 | ₹2,000 | ₹28,000 |

| 2 | ₹6,000 | ₹20,000 | ₹3,000 | ₹29,000 |

| 3 | ₹8,000 | ₹18,000 | ₹5,000 | ₹31,000 |

IRDAI note: Lower IDV reduces premium but increases risk.

Pros & Cons of Car Loan Without CIBIL

Pros

- Builds first credit score

- NBFC approval is possible

- Co-applicant lowers risk

Cons

- High interest rate

- Larger down payment required

- Limited bank choices

Tips to Increase Approval Chances

- Maintain clean banking for 6 months

- Avoid applying to multiple lenders at once

- Choose a cheaper variant to reduce loan amount

- Start a secured credit card to build CIBIL

- Offer higher down payment (30–40%)

- Use salary account bank first

Conclusion:

A car loan without CIBIL is possible—but comes with higher cost and stricter conditions.

Avoid shortcuts and always:

- Use trusted lenders

- Increase down payment

- Add a co-applicant if needed

- Build your credit for future loans

FAQ:

Q. Can I get a car loan without a CIBIL score in India?

A. Yes, it is possible to get a car loan without a CIBIL score, mainly through NBFCs, with co-applicant support, or by paying a higher down payment. Most banks usually do not approve such loans unless the applicant has strong and stable income proof.

Q. Which is the best car loan option without CIBIL in India?

A. NBFCs such as Tata Capital, Shriram Finance, and Mahindra Finance are considered better options for new-to-credit applicants, as they offer more flexible eligibility criteria compared to banks.

Q. Can CIBIL defaulters get a car loan?

A. Getting a car loan as a CIBIL defaulter is very difficult, especially through banks. Some select NBFCs may approve loans, but usually at higher interest rates and with requirements like a strong guarantor, collateral, or higher down payment.

Q. What is the interest rate for car loans without CIBIL?

A. Interest rates for car loans without a CIBIL score generally range between 12% and 18%, depending on the applicant’s profile, lender type, loan amount, and repayment capacity.