Auto Trader has unveiled its maiden dividend after sales accelerated in the first six months of the year.

The online marketplace for buying and selling cars said sales in the six months to September 27 grew 8pc to £138.2m, while underlying operating profit jumped 17pc to £83m.

The company, which listed on the London Stock exchange in March this year, continued to cut its cost base, which resulted in a 4 percentage point rise in the operating profit margin to a hefty 60pc.

Good cash flow allowed the company to continue to slash its debt pile and the smooth performance prompted management to announce its first ever dividend of 0.5p a share.

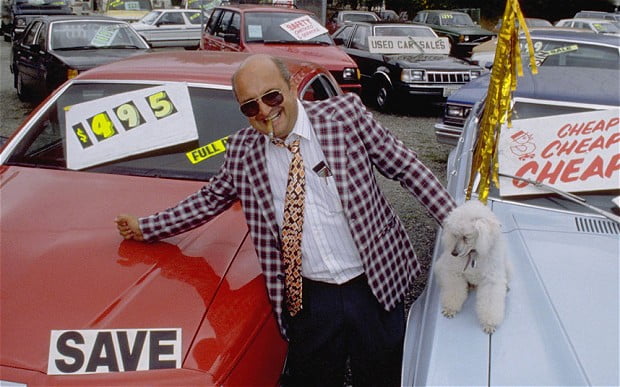

Auto Trader shares have surged since it listed

The relatively cheerful economic environment in the UK, combined with healthy growth in both the new and used car markets, have been a major boost for Auto Trader, which has seen its share price soar by 56pc since listing.

After 43 consecutive months of feverish growth in new car sales, registrations in the UK reached their highest level ever recorded in September.

Since then, the new car market has stabilised and actually dipped 1pc in October.

However, used car transactions remain robust, up 6pc in the year to June, and the sector is benefitting as large numbers of new cars bought over the past one to two years are coming onto the second-hand market.

Auto Trader had an average 427,000 vehicles listed on its website in the half-year. Audience growth was fuelled by smartphones and tablets, which accounted for 70pc of all visits, up from 64pc last year.

Audience growth was fuelled by smartphones and tablets, which accounted for 70pc of all visits, up from 64pc last year.

Revenue from trade customers grew 9pc to £115m, retailer revenue was also 9pc higher at £109m, while income from ‘home traders’ was up 12pc to £5.7m.

Chief executive Trevor Mather said: “Auto Trader has delivered a strong first-half performance, as retailers, consumers and manufacturers alike are increasingly recognising the value of our marketplace.

“We believe there is substantial opportunity to grow the business based on the increasing importance of the internet for automotive advertising.”

Auto Trader was a popular stock when it first listed and the steady rise in the share price suggests investors remain bullish on the outlook.

[“source-telegraph”]