Logistics companies has been on an uptrend after the introduction of sectoral reforms in the past couple of years. Future Supply Chain Solutions (FSCS), the third-party logistics provider, has been on an aggressive expansion spree in the past one-year and the reported another strong result in Q3 FY19. Earnings are anticipated to gain further traction as the company has a strong revenue pipeline and is planning further warehouse addition over the next 12-18 months.

Logistics companies has been on an uptrend after the introduction of sectoral reforms in the past couple of years. Future Supply Chain Solutions (FSCS), the third-party logistics provider, has been on an aggressive expansion spree in the past one-year and the reported another strong result in Q3 FY19. Earnings are anticipated to gain further traction as the company has a strong revenue pipeline and is planning further warehouse addition over the next 12-18 months.

Result snapshot

– Revenue from operations continued to rise on a sequential basis and touched Rs 333 crore in Q3 FY19, which implies a topline growth of 7 percent over Q2 FY19 and a 43 percent jump compared to last year’s revenue of Rs 232 crore.

Strong performance from the contract logistics segment, which contributes around 70 percent of total revenue, drove overall topline growth. Revenue from this segment surged 60 percent year-on-year (YoY) to Rs 236 crore in Q3 FY19. Addition of new warehouses, along with increase in capacity utilisation of existing ones, drove topline for this segment.

– Revenue from the express logistics segment was up 28 percent YoY, aided by strong volume growth. The temperature-controlled logistics as well as last mile delivery and agility solutions (Vulcan Express) also reported double-digit topline growth.

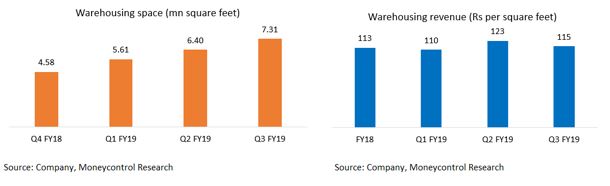

– Gross profit and operating margin declined as fixed costs increased due to addition of new distribution centres as well as new warehousing space. During the quarter gone by, FSCS added around 0.7 million square feet of warehousing space for its contract logistics segment. Total warehousing space at the end of the quarter stood at 7.3 million sq ft. Despite the space addition, the revenue metrics (revenue per square feet per month) was largely in line with previous quarters.

– The management has indicated that the margin could see some moderation due to the increase in competitive intensity from private equity-funded players and increase in lease rental expenses (up 8-10 percent YoY). This is, however, likely to get offset through a combination of technology integration, process improvements, working capital optimisation and improvement in capacity utilisation.

– The company has funded the recent capacity additions through non-convertible debentures (NCDs). With this Rs 200 crore debt infusion, net debt-to-EBITDA has increased to 0.8 times at the end of December 2018. The company is comfortable with the current leverage position, but this might increase to fund further expansion.

– While the company has added around 3.5 million sq ft in the last 12 months, it intends to add a similar space on the warehousing side over the next 12-18 months.

– Its growth prospects seem very exciting as the company has initiated a mega ‘India Food Grid’ project, which aims at developing a pan-India supply chain network for distribution of food and FMCG products through FSCS-leased warehouses and centres.

Outlook and recommendation

– The growth of logistics sector (1.5-2 times GDP growth) has direct correlation with overall economic growth. Given the recent policy changes, outlook for the sector as well as the company looks promising, although the growing concerns of a domestic slowdown (due to combination of global and internal factors) could taper FSCS’ growth aspirations.

– The company enjoys sticky relationship with its clients (3-5 year agreements in contract logistics segment) and its strong consumer focus (food, FMCG, apparel, footwear, consumer electronics etc) and revenue pipeline provides decent earnings visibility in an uncertain demand environment.

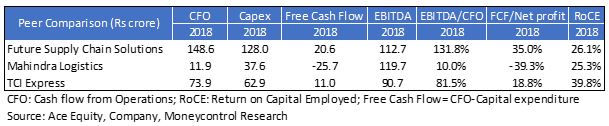

– On the operational front, the company has comparable return ratios in comparison to other third-party logistics players. Cash conversion remains healthy and the recent tightening of working capital requirements drives outperformance (vis-à-vis its peers) in this regard.

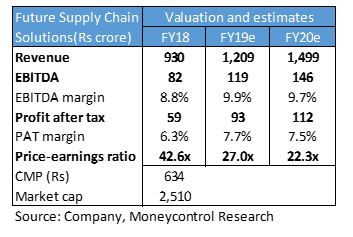

– The stock has been fairly rangebound despite broader market volatility. In terms of valuations, FSCS trades at a price-to-earnings multiple of nearly 22 times FY20 estimated earnings. We remain confident of the growth prospects of FSCS and expect the margin and return ratios to improve over the medium to long run. We advise long-term investors to look forward to accumulate FSCS on corrections.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

[“source=moneycontrol”]