Car ownership in India comes with two major responsibilities—valid insurance and updated RC (Registration Certificate).

Most first-time car buyers focus only on premium cost and miss critical terms like IDV, Zero Depreciation, NCB, and claim rules, which directly affect payouts during accidents.

This complete car insurance guide india for 2025 explains insurance types, renewal rules, claim steps, RC transfer process, and practical examples based on real Indian cases and IRDAI guidelines.

What Is Car Insurance in India?

Car insurance is a financial protection policy that covers your vehicle against damage, theft, and third-party liabilities. In India, insurance is regulated by IRDAI (Insurance Regulatory and Development Authority of India).

As per law, third-party car insurance is mandatory for all vehicles under the Motor Vehicles Act. Comprehensive insurance is optional but highly recommended for complete protection.

Types of Car Insurance in India

1. Third-Party Insurance

- Mandatory for all cars

- Covers damage/injury to others

- Does not cover your car’s damage

2. Comprehensive Insurance

Includes:

- Third-party cover

- Own-damage cover (OD)

- Fire, theft, natural calamities

- Accidental damage

Ideal for both new and used cars.

3. OD-Only Policy (New IRDAI Rule Option)

For cars already having a valid TP policy.

Key Terms You Must Know

IDV (Insured Declared Value)

The current market value of your car that the insurer agrees to pay if the car is total loss or stolen.

IDV Formula:

IDV = Ex-showroom price – Depreciation (%) based on age

Standard Depreciation Chart (IDV)

| Age of Car | Depreciation for IDV |

| < 6 months | 5% |

| 6–12 months | 15% |

| 1–2 years | 20% |

| 2–3 years | 30% |

| 3–4 years | 40% |

| 4–5 years | 50% |

| 5+ years | Mutually decided (market price) |

Zero Depreciation Cover

Zero Dep cover ensures no deduction for parts depreciation during claims.

What Zero Dep Covers

- Plastic parts

- Rubber components

- Fibre parts

- Paint

Limitations

- Available for cars up to 5 years (varies by insurer)

- Restricted number of claims

- Extra premium (₹2,000–₹8,000 yearly)

New Vehicle Insurance Rules in India

- Third-party insurance is mandatory for all vehicles

- Long-term bundled TP for new cars continues (3 years TP)

- Comprehensive policies can be renewed yearly

- PUC certificate required for renewal (in most states)

- Digital policy documents accepted (Parivahan/QR-based)

How to Choose Car Insurance in India

Step-by-Step

- Decide between comprehensive vs third-party

- Compare IDV—don’t pick extremely low values

- Choose add-ons:

- Zero Dep

- Engine Protect

- Return to Invoice (RTI)

- Roadside Assistance

- Check claim settlement ratio (CSR)

- Verify cashless garage network in your city

- Don’t skip NCB protection if no claims

Red Flags

- Forced add-ons at dealership

- Very low premium with high deductibles

- Unknown insurers without service network

Car Insurance Premium Example

Example: ₹8 Lakh Petrol Hatchback

| Component | Approx Cost |

| Base OD Premium | ₹12,500 |

| Third-Party Premium | ₹5,200 |

| Zero Dep Add-on | ₹3,000 |

| GST | ₹3,240 |

| Total Annual Premium | ₹23,940 |

How NCB (No Claim Bonus) Works

NCB is a discount on OD premium for claim-free years.

NCB Slab

| Claim-Free Years | NCB % |

| 1 year | 20% |

| 2 years | 25% |

| 3 years | 35% |

| 4 years | 45% |

| 5+ years | 50% (max) |

Car Insurance Claim Process in India

Cashless Claim

- Inform insurer within 24 hours

- File FIR (for theft/major accident)

- Surveyor inspection

- Repair at network garage

- Pay deductibles (if any)

- Drive out

Reimbursement Claim

- Pay full repair cost first

- Submit bills, photos, claim form

- Insurer reimburses after approval

Documents Required

- RC

- Driving licence

- Insurance policy

- PUC

- Claim form

- FIR (if applicable)

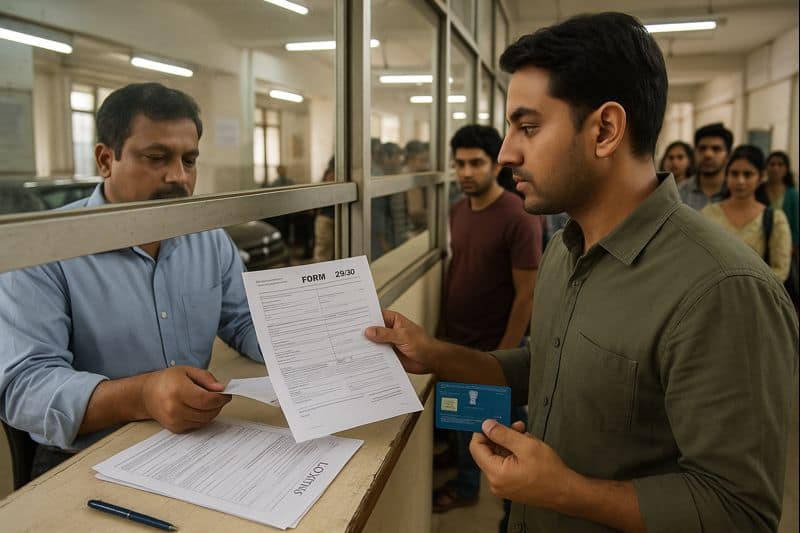

RC Transfer Guide in India

RC transfer is mandatory when selling/buying a used car.

Documents Needed

- Form 29 & 30 (signed by buyer & seller)

- Original RC

- Valid insurance

- PUC certificate

- Address proof

- PAN/Aadhaar

- NOC (if interstate)

RC Transfer Timeline

- Must apply within 14 days (same state)

- 45 days for inter-state transfer

RC Transfer Charges

- ₹150–₹600 for private cars (state-wise)

- Hypothecation removal: ₹150–₹500

Hypothecation & Insurance Link

If car is financed, RC shows HP (Hypothecation) with bank name.

Important Points

- NOC required from bank after loan closure

- Insurance must have bank as financer

- RC must be updated to remove hypothecation

Example EMI (If Loan Taken)

| Loan Amount | Interest Rate | Tenure | Monthly EMI |

| ₹6,00,000 | 9% | 60 months | ₹12,437 approx |

Common Claim Rejection Reasons

- Drunk driving

- Invalid DL

- Expired insurance

- No PUC

- Unauthorized modifications

- Delay in claim intimation

- Using private car for commercial purpose

Pros & Cons of Comprehensive Insurance

Pros

- Covers accidental & own damage

- Theft and natural disaster protection

- Higher resale value confidence

Cons

- Higher premium than TP only

- Add-ons increase cost

- Claim may reduce NCB

Tips to Reduce Premium Without Losing Coverage

- Increase voluntary deductible

- Transfer NCB during sale or renewal

- Compare premiums online

- Avoid unnecessary add-ons

- Renew before expiry (avoid inspection)

- Choose correct IDV—not too low

Conclusion:

Insurance and RC management are not one-time tasks—they are continuous responsibilities. Choose the right coverage, maintain updated documents, and understand claim rules to avoid financial loss.

FAQ:

Q. Which is the best car insurance in India?

A. There is no single best car insurance provider for everyone. The right choice depends on factors such as cashless garage network, claim settlement service, Insured Declared Value (IDV), and premium amount. Popular and reliable insurers in India include ICICI Lombard, HDFC Ergo, Bajaj Allianz, and Tata AIG.

Q. Is Zero Dep insurance worth it in India?

A. Yes, Zero Depreciation insurance is worth it, especially for cars under 5 years old. It prevents depreciation deductions during claims, significantly reducing out-of-pocket expenses on plastic, rubber, and metal parts.

Q. How should I choose car insurance renewal in India?

A. While renewing car insurance, compare IDV, add-on covers, No Claim Bonus (NCB) protection, premium, and the insurer’s claim settlement ratio (CSR). Avoid choosing the cheapest policy blindly always check the insurer’s garage network and claim reputation.

Q. Can I claim insurance without RC transfer after buying a used car?

A. Claims can get delayed or rejected if the RC transfer is not completed. It is important to apply for RC transfer immediately after buying a used car and inform the insurer about the change in ownership.