Auto Industry Disappointed With Additional Cess On Larger Cars, SUVs

The Indian auto industry is disappointed with the Union Cabinet's decision for…

Additional cess above GST to be removed on used car sales

Earlier Maharashtra had enforced an additional road tax of 2 percent on…

Additional cess above GST to be removed on used car sales

NEW DELHI: Good news seems to be in the offing for the used car market.…

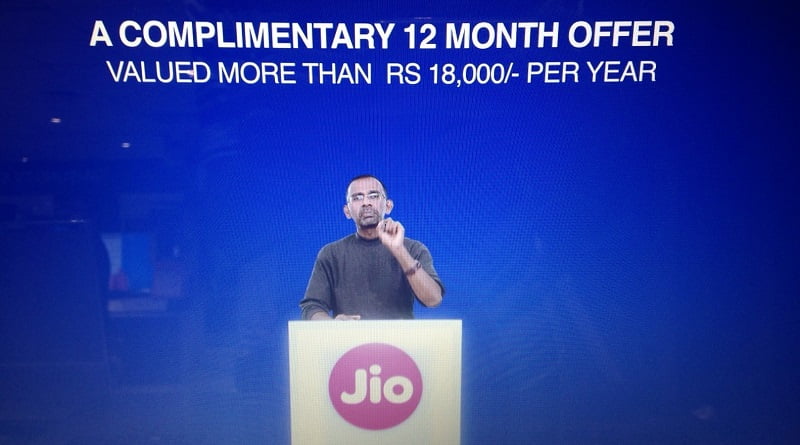

Reliance Jio iPhone Users to Get Additional 12 Months of Free Service

Reliance Jio today announced a partnership with Apple to offer iPhone customers…

First-Time Home Buyers to Get Additional Tax Deduction

To lower the burden for first-time home buyers, Finance Minister Arun Jaitley…